If you want to buy a home and don’t have the cash to pay it in full, you’ll need mortgage financing. It may sound complicated, but it can be simple once you understand how the process works.

The more informed you are when you apply for a mortgage, the easier it will be to complete the process on time.

Here’s how it works.

When you think you’re ready to buy a home, consider getting pre-qualified. This could be six months to a year before you actually buy a home. But, the pre-qualification helps you understand the amount you can borrow and what conditions you must satisfy.

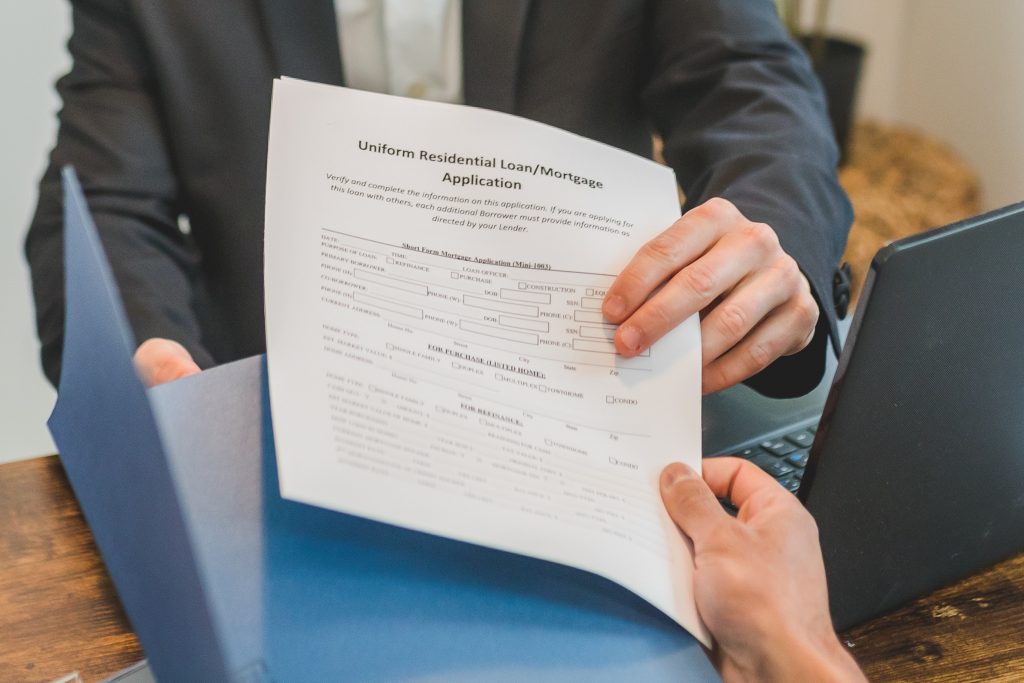

To get pre-qualified, you’ll talk to a loan officer and discuss your income, assets, credit score, liabilities, and employment. The loan officer uses this information to determine which loan program you might fit into and what you’d need to qualify.

When you’re ready to look at homes and possibly make an offer, it’s time to get pre-approved. This is a step up from pre-qualification and requires you to provide proof of the information you provided for the pre-qualification.

Most lenders ask for the following:

If you meet the guidelines, the lender will provide a pre-approval letter that states the maximum sales amount, loan amount, interest rate, terms, and conditions you must satisfy.

With your pre-approval letter, you can view homes and make offers. However, most sellers and real estate agents won’t accept offers and sometimes do not show homes unless you have a pre-approval letter.

You can make an offer through your real estate agent when you find a home. The seller may accept, decline, or counteroffer the bid. This can go back and forth several times, and if you finally agree, you’ll sign a sales contract.

You must submit your sales contract to the underwriter immediately. This is also an excellent time to provide any other outstanding documents to satisfy other conditions on the pre-approval letter.

The underwriter will also order the title search and appraisal. The title documents prove the home has no liens, and the appraisal confirms the home’s market value to determine its worth as much as the sales price.

You might go back and forth a few times throughout the underwriting process, checking off conditions. Once you clear the conditions, the lender can issue a clear to close, and you can head to the closing table.

At the closing, you’ll sign documents, including the mortgage and note, putting the house up as collateral and providing funds for the down payment and closing costs. After everyone signs all documents and funds exchange hands, you’ll receive the keys to your new home.

The mortgage process is seamless when you work with the right lender. Therefore, you must start with the pre-qualification process and work your way down the line to have the most seamless home purchase process.

Disclaimer

Niko Law LLC is an Illinois law firm. As the firm practices law in the State of Illinois, only, this website and/or e-newsletter focuses upon that jurisdiction, only. Please keep in mind Niko Law LLC does not guarantee results and that law can vary dramatically from state to state, county to county, and it is not reasonable to assume that law in other jurisdictions will be the same as, or even similar to, Illinois law.

This e-newsletter should not be construed as legal advice, nor used in lieu of a lawyer.

For questions regarding your specific situation, please contact Niko Law LLC at 708-966-9388.

Aug

Establishing a Will & Trust Is Important Estate planning and real estate are two interconnected aspects of life that often go hand in hand. While real estate investments can significantly contribute to your overall estate, it’s essential to understand how these assets should be managed and distributed to secure your legacy. Understanding Estate Planning and […]

Jul

Why Do Taxes Increase Every Year? Property taxes can increase for a variety of reasons, and the specific factors affecting your property taxes may vary depending on your location and local government policies. Here are some common reasons why property taxes tend to increase over time: Increased Property Value: If the value of your property […]

Jun

What Happens If I Am Selling My House and My Purchase Gets Cancelled? The process of buying or selling a home can be complex. One of the most common concerns is what happens if a sale falls through after an offer has been accepted, and whether canceling an accepted offer due to unforeseen circumstances can […]